This is the first in a series of articles describing the practical use of digital technologies (AI + cloud) and Financial Data Intelligence in market analysis and speculation. The subject of this speculation will be KGHM, the top Polish copper stock listed on the Warsaw Stock Exchange, and (indirectly) the copper futures contract (Commodity Exchange Inc.), along with the portfolio of copper industry stocks (the U.S. Stock Market).

A successful speculator plays a waiting game. Most people cannot wait; they would rather wager, and the sooner the better. Speculator kings and queens have the patience to put off taking action until the tumblers have clicked into place, knowing that profits are then more likely to prevail.

Larry Williams Long-Term Secrets to Short-term Trading | 2nd edition 2012

Intro

As an individual investor a few years ago, I bet on the development of digital skills in cloud computing, coding, and predictive AI. I decided to be pragmatic and immediately started working on market data, given public access and the ability to process it without limitations.

In 2020, I built the first neural network (CNN) capable of detecting above-average volatility in stock charts.

At that time, the topic of AI was still little known in the market context. The results of this work encouraged me to continue developing technology to support my market activities.

Currently, thanks to technology, I analyze market situations mainly through the prism of Smart Money behavior on the American market, but this article will show that this approach can also be applied to the domestic Warsaw Stock Exchange by focusing on KGHM and instruments related to the commodities market.

I can’t describe all the transactions over the past few years, nor the details of multi-threaded analysis. This article primarily aims to show that investing “in oneself” is the best investment an individual investor can make, and that technological support in the trader’s decision-making process can only help gain an advantage over other market participants.

In this article, I will present my approach to the trading by focusing exclusively on data from the U.S. market, without considering what is being said in the Polish stock market media. I will focus on examples from 2024 and 2025 (short reference), when the copper market was transitioning from consolidation into strong upward trends.

Technology Stack

For me, technology implementation is a top priority. Data analysis, process automation, and effective use of AI models give a significant advantage over “analog” market players. I cannot deny that technology sets a relatively high entry threshold for those who want to be proficient in the skills mentioned here.

In my market journey, I make extensive use of digital technologies. The most important ones include:

- public cloud

- predictive AI: Machine Learning / CNN / NLP

- LLMs / Gen AI

- personal application code for statistical analysis

- data engine (Cribl) / SIEM (QRadar)

- automation of analytical and system processes (Ansible)

- Amibroker

- Grafana

This technology stack is utilizing the following data:

- CFTC / Commitments of Traders (COT) Reports

- OHLC + stock volume

- market news

- macroeconomic data

“Smart Money” vs “Dumb money”

I will refer to the classification (Smart Money) of CFTC (Commodity Futures Trading Commission), although you can find different interpretations in the literature:

-

Smart Money:

- Commercials Traders use financial instruments to hedge their business activities. In this group, there may be a producer of some commodity, an international corporation hedging its currency operations, etc. We are talking about “big money” in terms of market positions.

- Non-Commercials, the other side of Commercial Traders, is driven mainly by profit, just like the “retail traders”.

-

Dumb money: Retail traders and investors trading with their own means. Mostly people without appropriate preparation, acting under the influence of impulse (news, geopolitical event), emotions, without a defined trading strategy.

Positional Analysis / Commitments of Traders (COT) Reports

The positional analysis examines changes in the positions (behaviors) of Commercials and Non-Commercials in a specific market.

In my opinion, the subject of CFTC / Commitments of Traders (COT) Reports is not very popular among retail traders in Poland. The situation is definitely not helped by the lack of Polish literature related to the subject.

Role of Market News

While I agree with the theory that media noise does not help decision-making in the market, news analysis needs to be approached in a certain way, and there’s a logic to it. As we know, if something is already in the news, it’s already in the price. But the last few years drew my attention to these aspects:

- The use of AI (NLP for sentiment analysis) for key sector companies may prove important.

- News often serves as a trigger for “retail traders” to enter the market.

Role of AI / ML

For the past 6 years, I have been engaging with AI, building neural networks and models. I primarily use Predictive AI. In this article, I will refer to at least two forms of AI that assist me in the decision-making process.

In this article, I aim to show that it’s worth exploring this area, and there’s more than just Gen AI.

Year 2024 (April - July) | First “copper train” departure

It’s early April 2024, KGHM stock is breaking out of a year-long consolidation period. However, significant anomalies occur in the market data a few weeks before the “train” departure. Below is the schedule of transactions concluded in 2024, which I will describe in more detail in the following sections.

Stage one: Market listening and Scenario Building

Week 11, 2024 (11.03 - 17.03)

An important week for the start of the overall trend: news, volume, earnings from the entire portfolio of copper companies, and insights from positional analysis.

Significant news hitting the retail investors (examples)

13.03 Wednesday

From the news, we learn about China’s decision to reduce copper production. Also talks about Southern Copper Corporation as the most attractive in the entire mining portfolio.

An overall well-explained “reason” for the “retail investors” why it would be wise to invest in the copper sector now.

17.03 Sunday

Retail investors can read here about the copper futures price breaking out of a consolidation and the volume play on this contract.

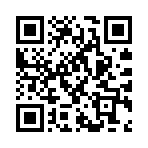

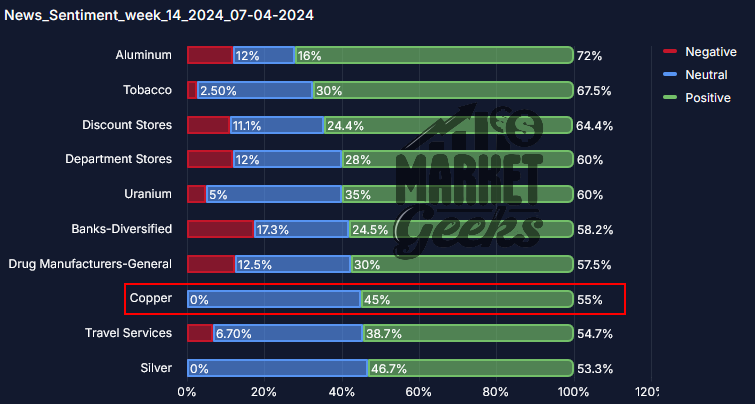

Let’s look at the weekly sentiment of the news for the portfolio of copper companies. Of the 100 analyzed sectors, the copper industry ranks third in terms of the percentage of positive news (55%) available online. Negative news accounts for only 5%. Conclusion: The “retail investors” in 95% of the cases read about copper companies positively or neutrally. This sector is emerging as a potential investment opportunity for those who read the news.

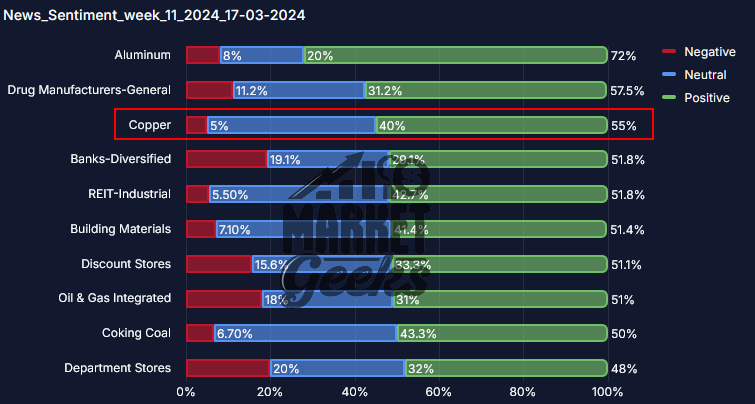

Volume on industry stocks

After a series of news, volume spikes appeared on industry stocks charts over the next two days. The news may have played a part in this. This is usually indicative of an attempt to draw the “retail traders” into further play. I believe it’s worth keeping an eye on the future development of the situation in this market.

In the coming days, we also see increased volume in KGHM stock. For me, this signifies funds from outside of Poland buying KGHM (in Poland, it is still too early to consider KGHM a great investment, but I could be wrong).

Portfolio of the Sector

All the elements we discussed above contributed to the significant upward move of the sector companies at the end of the week.

COT Positional Analysis

Positional analysis will recur over the next few weeks, leading up to and during the trades.

Here I present the most striking observations:

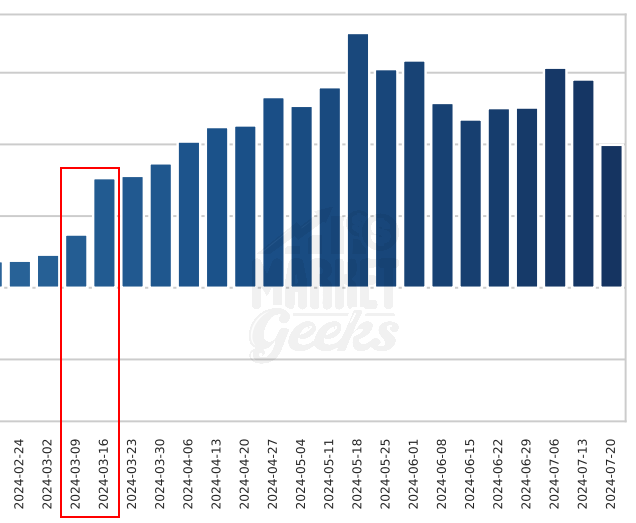

- In mid-February (1), a local extreme of Commercials NET Long position formed; it couldn’t be recognized as an extreme at the time, but from the perspective of week 11 2024, yes. Since then, commercial traders have steadily reduced their (Long) positions.

- In week 11, 2024, Commercials transitioned from NET Long to NET Short

- I see that market participants’ positioning favors a potential upward spike in copper prices, and all that’s needed now is a “trigger”.

Week 12 2024 - Significant message from FOMC / FED

On March 20, 2024, U.S. Federal Reserve Chair Jerome Powell conveys information about an upcoming series of rate cuts. This gives a green light for potential rallies not only in the copper mining sector.

-

Federal Reserve still foresees 3 interest rate cuts this year despite bump in inflation (AP)

-

Fed’s Powell says balance sheet drawdown taper coming soon (Reuters)

-

Stocks surge after Fed indicates three rate cuts still coming this year

Week 13 2024 - Social Media Monitoring

25.03

On groups related to (retail) trading, posts about “trading KGHM” begin to appear.

After that, I have no doubts that the retail traders have been drawn into the game. I prepare to enter the market, assuming that KGHM (just like Copper) will take off.

I’ll also revisit positional analysis here.

- From week 12 to 13, we see (2) that Commercials significantly reduce their position; it’s clear that the change is substantial, they reduce it by 32 thousand contracts towards NET Short within one week. The black horizontal line represents level 0

Stage Two - The Gameplay

01.04 - More news

From this article, retail traders can infer that, in the case of rate cuts, copper as a commodity will be the first to rally. This news is related to the previous one from 20.03.2024.

02.04 - AI suggestion + price rejection (LAL RRT)

Since 28.03, copper has entered a period in which Smart Money’s action favors growth (vertical green lines on the chart above). AI helped create such a profile based on a series of indicators I use in my positional analysis.

In addition, something like LAL #RRT (price rejection pattern) on KGHM is forming. Therefore, I set myself with an entry above. Of course, this LAL #RRT has a significant drawback: it falls within the range of the previous price movement. Nevertheless, in the context of #COT, I do not rule it out entirely.

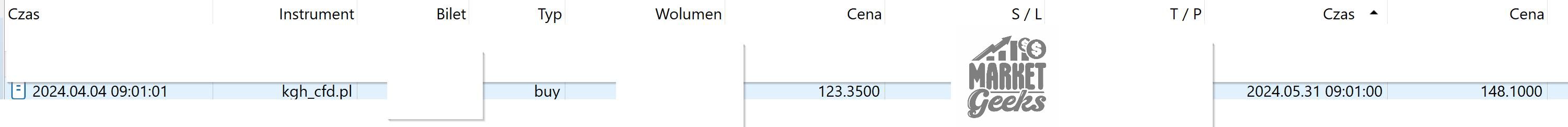

04.04 - Opening Long position on KGHM

I open a Long position on KGHM (CFD)

07.04 - Sentiment once again

It is worth paying attention to one thing. Although Copper companies are dropping from 3rd place, negative news is completely disappearing. Quick conclusion: a typical retail investor browsing news online about the copper mining sector will not find anything negative about it.

12.04 - COT Analysis | Week 15

- (3) Commercials reduce their Long positions again

14.04 - What the autoencoders say | Week 15

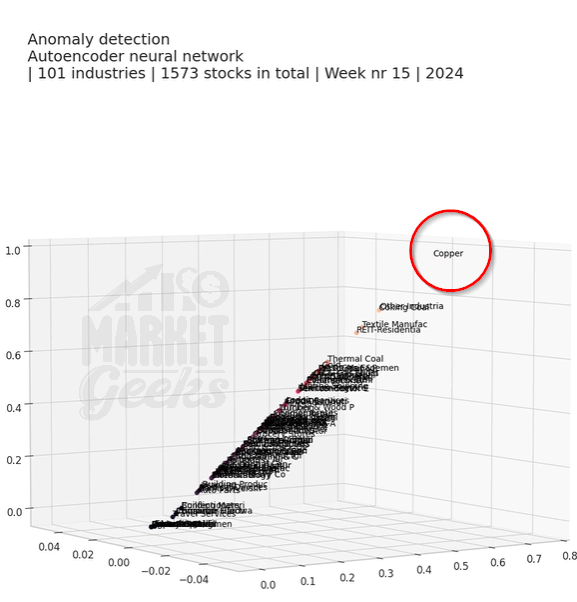

This week’s analysis of industry stocks behavior using autoencoders (neural network) clearly points to the “Copper” sector. As we can see on the 3D chart, the “Copper” sector clearly deviates from the rest of the 100 other sectors listed on the US stock market. This confirms that strong gains in the sector are behind detected anomaly.

05.31 - Closing the Long position

I am closing the Long position with a profit on 05.31

Closing the position for three reasons:

- possible signal (4) of change in dynamics in COT (priority)

- another LAL #RRT (5) this time for a price drop, which formed before the signal from COT.

- as we can see, AI also detects that Smart Money stops driving price upwards when the closing day (long position)falls outside the “price strength” area. The price of copper has entered a transitional period (no green vertical lines).

After exiting the position, the price continues to fall, then an upswing forms. For me, this means that the retail traders may want revenge.

Stage Three - The Play-off

Possible scenario: The retail traders drawn into a trap

After a strong upward move, a correction takes place. Many retail traders take Long positions in the hope of further gains. I analyze COT data and do not share the crowd’s optimism. In my opinion, a further price growth scenario may be compromised.

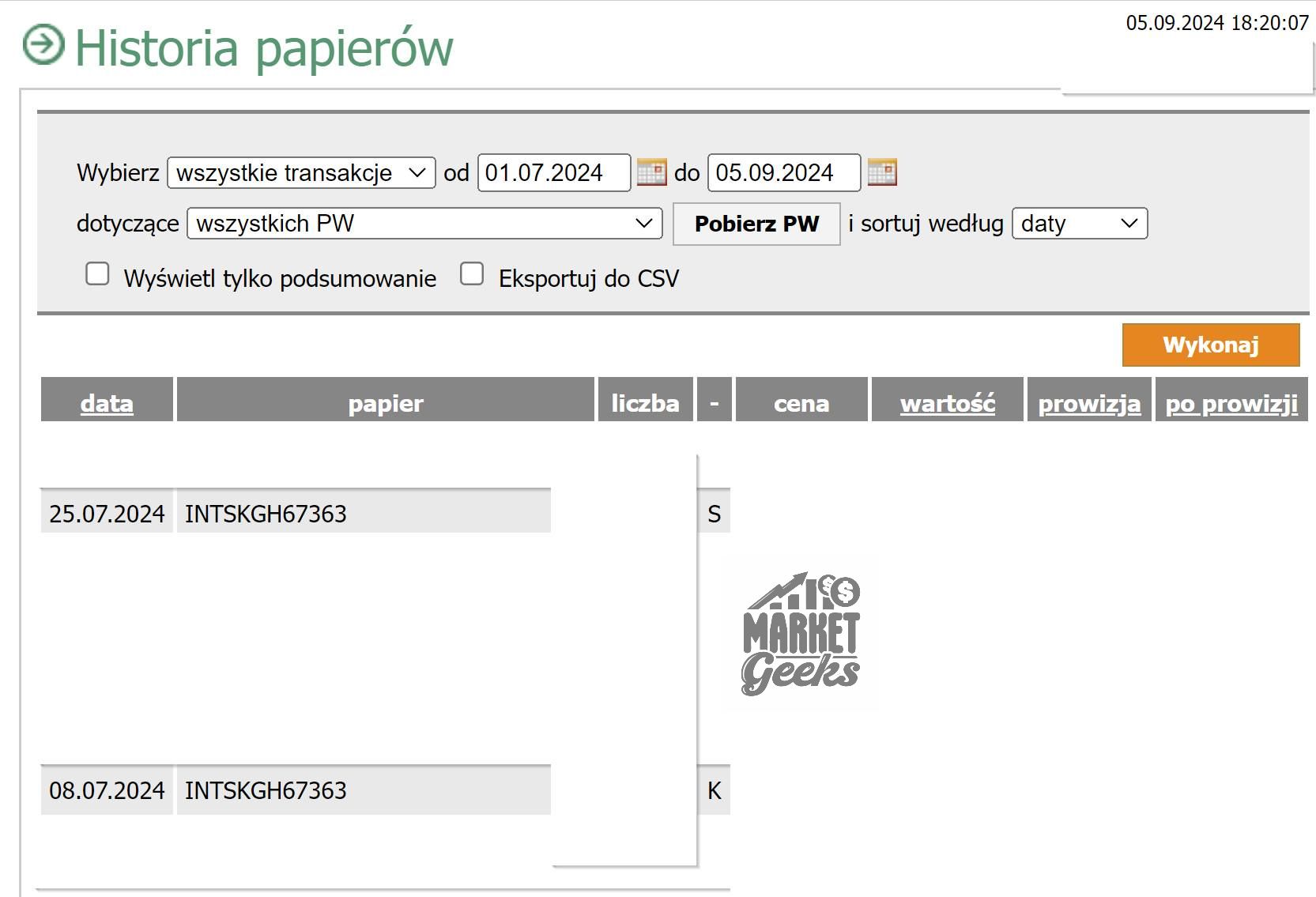

08.07 - Opening Short postion on KGHM

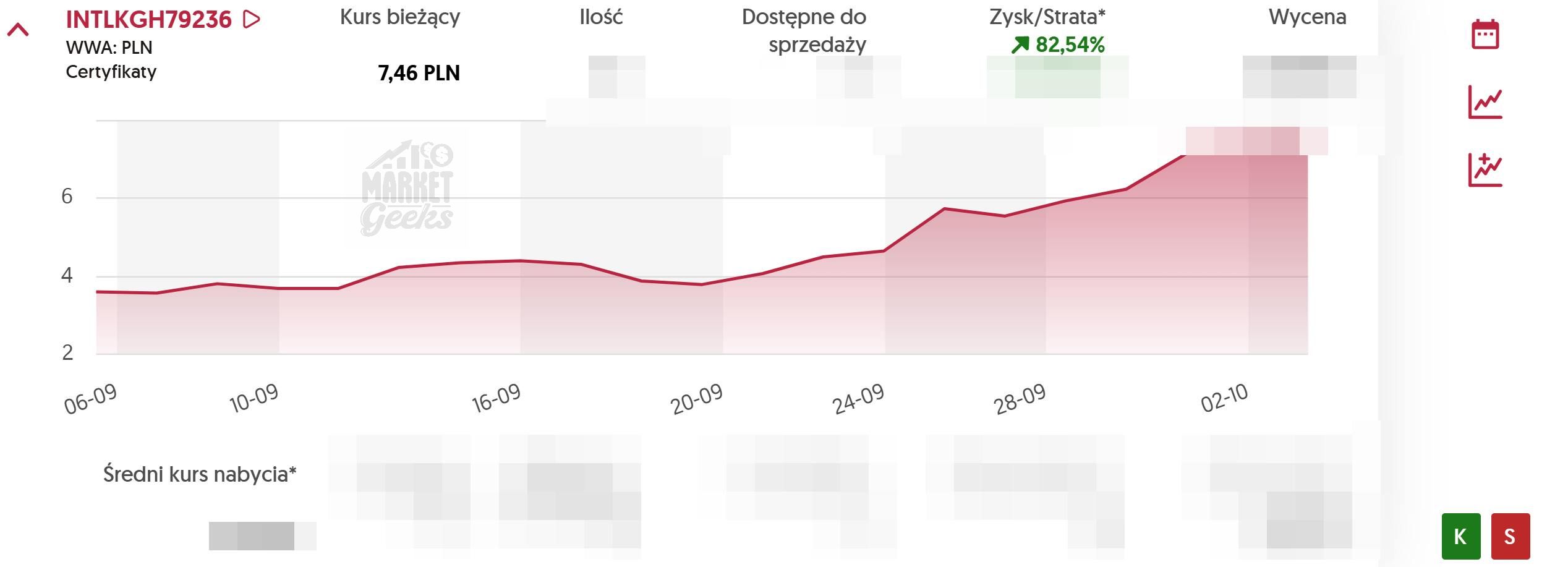

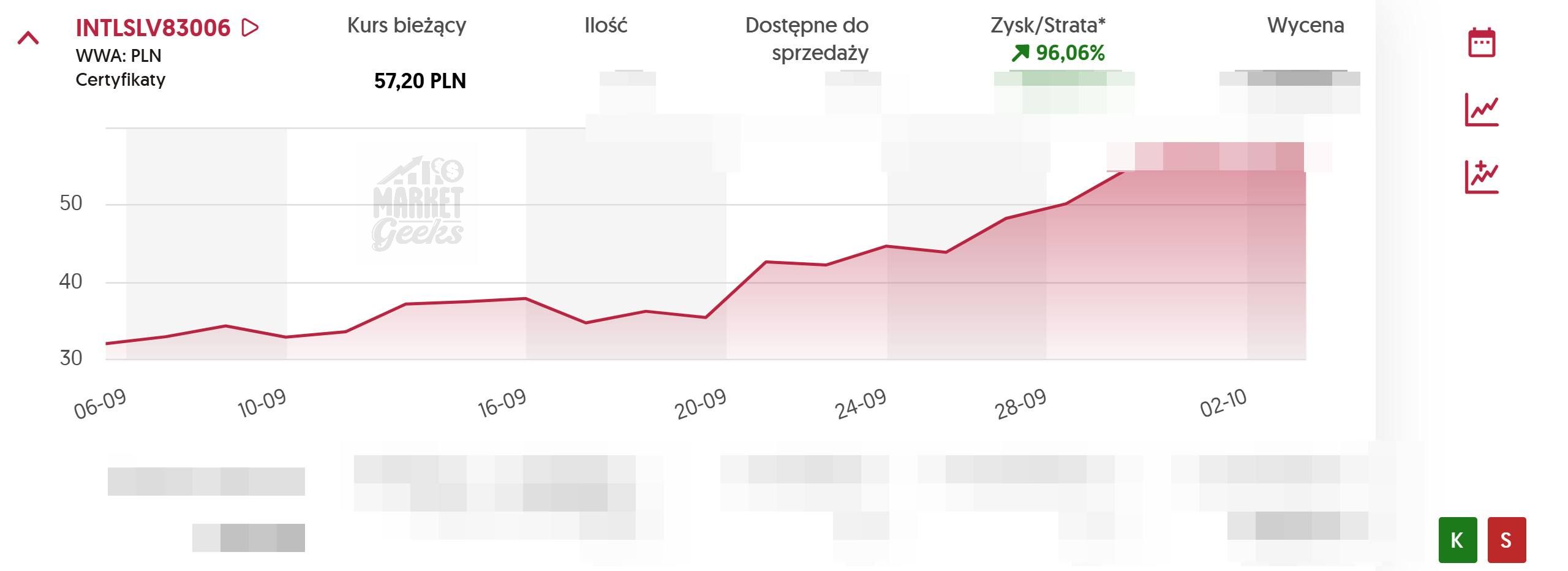

I am proceeding with my scenario and, on 08.07.2024, I am buying short certificates (KGHM), waiting for a violent “break” in the price. (I see the weakness of this price up-swing), which occurs after 6 trading sessions.

25.07 - Closing Short Position on KGHM

On 25.07.2024, I sell the purchased short certificates at a profit (red arrows). Retail traders were drawn into a trap again, and many are left at a loss, having to give back what they previously earned.

Year 2025 - another departure of “the copper train”.

The end of September 2025 marks continued upward movement in the copper industry stocs. In my scenario, entering a Long position on KGHM occurred in the summer of 2025 and was driven by developments in the silver market, among other factors.

The whole scenario was holistically connected to the demand for AI and everything that accompanied it (energy demand, the construction of Data Centers, etc.).

This seems to be material for another article that is in the plans. Below, I am posting screenshots from October 2025 regarding the positions I held on KGHM and silver.

I am posting this for educational purposes. I learnt a lot from it - hopefully others will also see its value and approach the market with a cooler head or simply back off (which is not a shame).

Editorial Note

- The first edition of the article took place on February 3rd, 2026.

- Stock charts and animation (bar replay) were generated in AmiBroker software.

Disclaimer

- The information provided in this article is not intended as investment advice. It is crucial to conduct your own research and, if possible, perform backtesting before engaging in any trading activities.

- The content presented in this article is for educational purposes only and should be understood as such. These are the private opinions of the author, and in no way, in part or in entirety, constitute investment recommendations.

- Prior to making any financial decisions, it is strongly recommended to seek guidance from a registered investment advisor.

- The author is not responsible for investment decisions made on the basis of the content presented here, nor for losses that they may have caused.

- The content presented should not be understood as an incentive to invest or speculate financially.

Copyright Disclaimer

The content of this article is protected by copyright law. Unauthorized use, reproduction, or distribution of any part of this content without written consent is strictly prohibited. Written permission must be obtained before any utilization of the material.

Editorial team